12/20/2017 update:

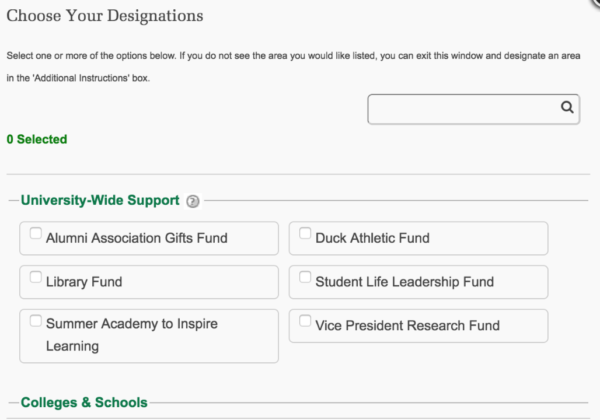

In response to my note the UO Development Office has now added SAIL to the list of “other” funds. Just go to the secure UO giving page at https://securelb.imodules.com/s/1540/foundation/2col.aspx?sid=1540&gid=1&pgid=408&cid=1095, click the “I want to view additional options” box, and you’ll get this pop-up:

Click Summer Academy to Inspire Learning, then you’ll be asked how much, contact, info, ccard info. Thank you!

12/19/2017 update:

With only 12 days left before President Grinch’s tax “reform” increases the after-tax cost of giving – drastically for most of us – now is the time to give on the cheap. Even the Duck coaches, or at least one person working for athletics, have now got into the act with a pledge to the State Employee’s Charitable Fund Drive:

![]()

If you give this way and don’t have a lot of deductions (i.e. a big mortgage) you should consider switching from a monthly payroll donation to making a one-time gift before Jan 1. The phone number is on their website here. You can pick which of a list social welfare and other charities you want to send the money too. Very easy.

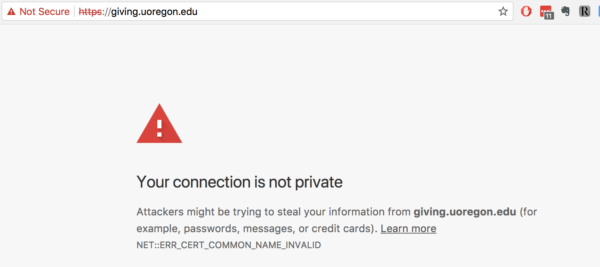

That’s for UO employees giving to state and local causes. As Honest Uncle Bernie reports, giving to UO is a bit harder. I like the Duckfunder website: https://duckfunder.uoregon.edu/ It has a few active campaigns at the moment, but it’s not very good crowdfunding because it doesn’t connect donors with related causes or vice versa. Meanwhile the main UO giving site, https://giving.uoregon.edu is not even secure:

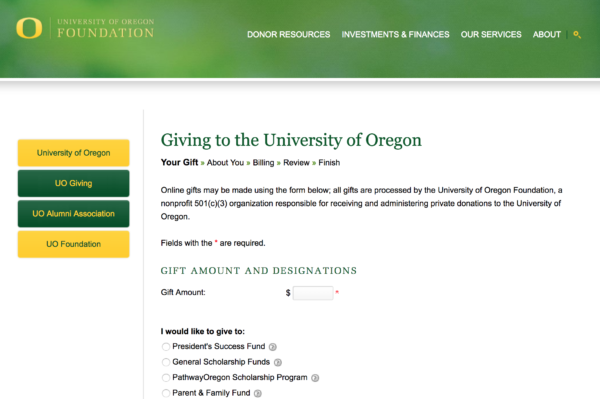

Which sort of puts you off leaving a ccard number. However, if your browser lets you get past this, you’ll eventually find the UO Foundation’s secure giving webpage at https://securelb.imodules.com/s/1540/foundation/2col.aspx?sid=1540&gid=1&pgid=408&cid=1095:

If you click on “other” you get a poorly formatted list of other funds. If you want to give to, say, SAIL, sorry, it’s not on the list. So go back and type it in yourself. The UO Foundation will mail you a nice letter on O letterhead suitable for showing to the IRS, or what’s left of it now that Trump is in charge, confirming your money will indeed go to SAIL.

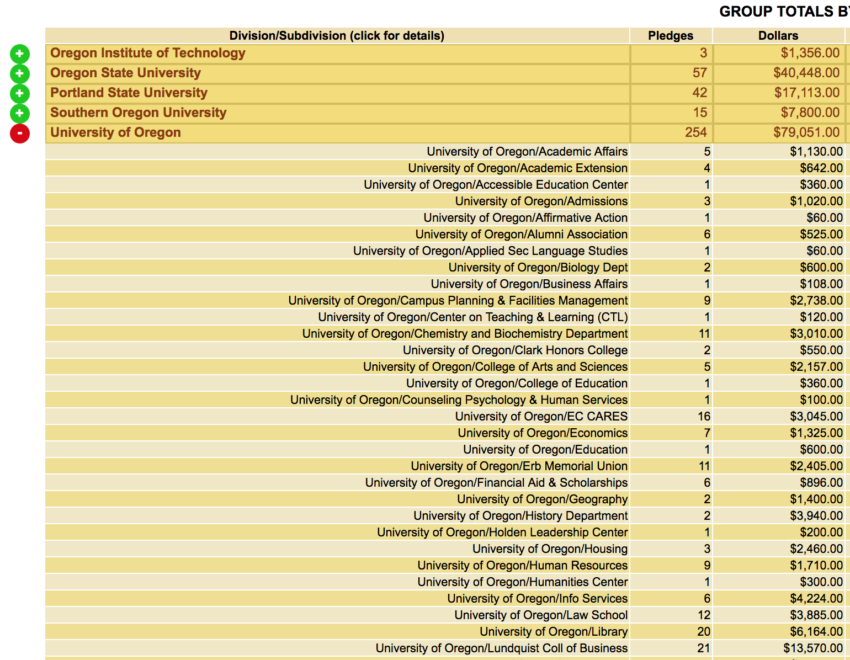

12/3/2017: UO librarians crush Duck coaches $6K to $0 in Charitable Fund Drive giving

Every fall Oregon runs a Charitable Fund Drive for state employees. Everyone on the state payroll gets a few emails asking them to donate to local and state charities. You know the drill. You can give lump sum or sign up for convenient monthly payroll deductions. (I reccomend lump-sum, given what Trump is about to do to the tax code.)

You pick which charities you want to give your money to, and you can opt out of receiving junk mail requests for more money. Sensible and efficient. UO employees usually give about $300K in total. Sign up here.

The librarians are usually big givers. I’m no expert on charitable giving, but I’m guessing this isn’t because of their high salaries. The B-School is also very generous.

As in years past, the Duck Athletic department is the outlier on the low side, despite the fact that the Ducks have many employees bringing in considerably more than the average UO librarian. So far Rob Mullens, Dana Altman, Willie Taggart, and the athletic department as a whole have given $0, or 0% of their pay and bonuses:

…

Payroll deduction is not a very efficient way to donate to charities for highly compensated individuals. Donating appreciated assets via foundations, trusts, donor advised funds, etc. is how affluent (and many not so affluent) donate to charities.

You write, “I’m no expert on charitable giving, . . .” and I’m wondering if you are being facetious, humble-bragging, signaling or you are honestly unaware of how the affluent and highly compensated individuals donate differently to charity than the non-affluent and non-highly compensated. If I were a highly compensated individual and my financial advisor or “expert on charitable giving” told me to donate to charities via payroll deduction, I would start looking for another advisor.

I enjoy your blog, but you are better than this.

Sorry for any confusion. By efficient I meant in terms of minimizing the informational costs to givers (you get a handy list of charities, all of which have passed the state’s screening process) and in terms of minimizing the costs to charities of competing for givers with glossy brochures, expensive mailing lists, etc.

I agree with your point in terms of the personal financials, but also in terms of optics, a department which routinely pays single individuals more money than I expect to make in my lifetime for one year of directing people (of color, largely) to concuss themselves* might want to just play this game anyway. The individual financial hit for a guy making $3M a year if he (because duh, women coaches don’t make $3M) chucks $10K at Food for Lane County this way is basically negligible, and if say the head football coach, the head basketball coaches, and half a dozen high-pay assistants put in a nice chunk, then Athletics can look like it’s leading the way here. Probably that would be good for their image AND great for our local charities, and it’s not mutually exclusive from donating via the other routes you name.

*Full disclosure: I am a fan of some of these concussion-inducing events; this doesn’t preclude me also being a fan of measures to curtail brain injuries, economics that require making bank on the bodies of African-American men, or annual coach salaries that would fund some of our smaller departments outright.

How much to buy a seat at the Trustees table? Or do I need to ask the governor directly?

Surely you don’t think the Governor is in charge of UO Trustee appointments?

Just need to know who to write the check to, and how much.

I am posting this comment anonymously, which in this case I think is appropriate. I gave what for me was a sizable gift to SAIL and received absolutely no acknowledgement or thank you. This would not stop me from giving again, because I strongly believe in what SAIL does. But I think it is consistent with best practices and norms of courtesy to thank donors.

Thanks for letting me know. I think we are usually very good about this. Please email me at [email protected] so I can follow up and make sure it’s not a systematic problem. And thanks for the gift!

As noted here, the UO online giving setup is terrible! Almost like they don’t give a damn. I want to make a gift to a nonlisted subunit. I have no way of knowing whether the donation will actually end up where I want.

Why are a few institutes and programs listed, but not others?

It is all haphazard and bush league.

Where are the admin and trustees on this?

I was so frustrated the online site that I hand-delivered a check to the Foundation office in the Ford Alumni Center and told them how awful it was.

I have donated to SAIL and will again. We did get a nice thank you note, but humorously, addressed to “Mr. and Ms.” when we are both professors at this very university. Apparently the right hand and left hand are not connected!

Not exactly off topic — a must read from the Oregonian on “whute nationalism” in hip Eugene:

http://www.oregonlive.com/pacific-northwest-news/index.ssf/2017/12/post_292.html#incart_target2box_default_#incart_target2box_targeted_

In general, I think culture is getting less enlightened as time

goes on. Not a wise direction if we want any real world problems

to be solved.

But hey, I teach this stuff and none my students listen to me or

actually believe any thing that actually happened in history, so …

On topic, I think — the American Talent Initiative — a consortium of universities, some public, seeking to increase socioeconomic diversity — UO not presently a member:

https://americantalentinitiative.org/who-we-are/