5/15/2012: The IRS makes non-profits submit “990” forms annually, to show what public good they’ve been doing with that money they are not paying taxes on. The OSU Foundation turned in theirs 6 months ago. CEO J. Michael Goodwin pulled down $414,792 in total compensation. The top 5 employees take was $1,436,454. All 5 are safely in the 1% – and to think they did it working for a charity. Impressive!

Where’s the equivalent UO info? Well, the UO Foundation hasn’t filed yet – they’ve now gone through two 3 month extensions from the IRS. The IRS rules for a 990 extension are considerably more lenient than most professor’s: “Additional time is needed to gather the information necessary …” But now time’s up. The IRS wants that 990 today, May 15.

So, can CEO Paul Weinhold and the rest of the UOF execs top OSU? I’ll post the form as soon as they send it along. Honestly, the OSU salaries are going to be tough to beat. But this summer the UOF annual report showed they were cutting their payments to academic scholarships by $1.4 million, while increasing administrative expenditures by $2 million. So my money is as good as yours on this one. (In fairness to Mr. Goodwin, the OSU Foundation CEO directs both fundraising and investing/money managing. At UO the VP for Development job is separate and part of UO, not the foundation.)

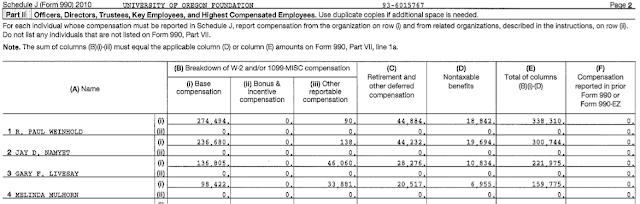

Update: Here’s the UO F 990 form, which they sent over promptly and, this time, completely. I’ve got to admit it’s a pleasant surprise. We’re paying CEO Weinhold just $338,3310, and the top 5 employees are only getting $1,150,000 or so total:

The rest of the report is quite interesting. The Foundation spent about $500,000 lobbying for the New Partnership, pays some very high consulting fees, and still refuses to break out it’s contributions to UO into athletics/academics categories.

I mistakenly deleted all comments to UO Matters from 5/12 or so til now. I’m very sorry, there were some good ones too! I tried to recover them, but can’t.