UO administrators and Republican legislators love doom and gloom stories about the cost of PERS and its outrageous retirement benefits. But the truth is that they’re repeating fake news, and are now going to have to look for a new bogeyman. The truth is that the state could redirect a significant portion of the PERS money it’s now sending to Wall Street and use it for spending that would would help Oregon. This made sense before Covid and it makes even more sense now.

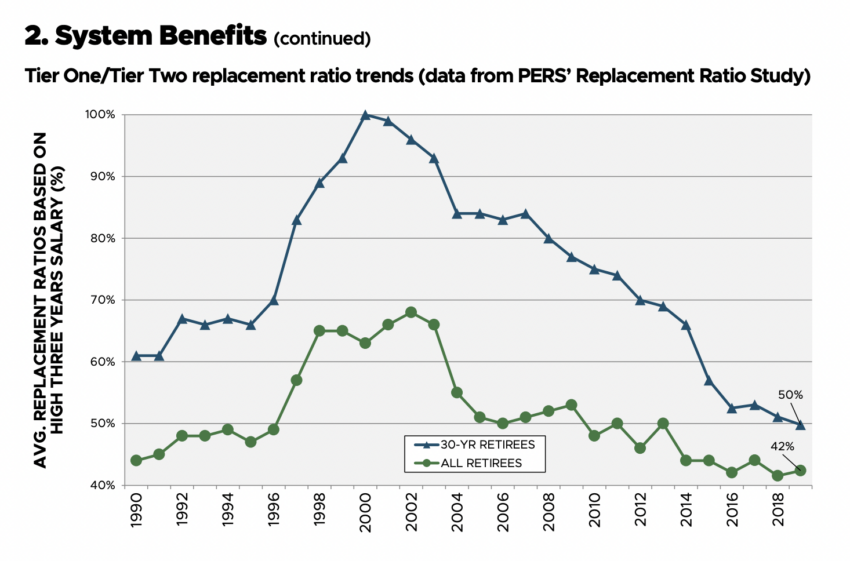

From PERS by the Numbers: While Mike Belotti and his ilk are still sucking on the what Huey Long called the government sugar-tit, past reforms have already reduced typical PERS payouts for new retirees from 100% to 50% of their top 3 years of salary:

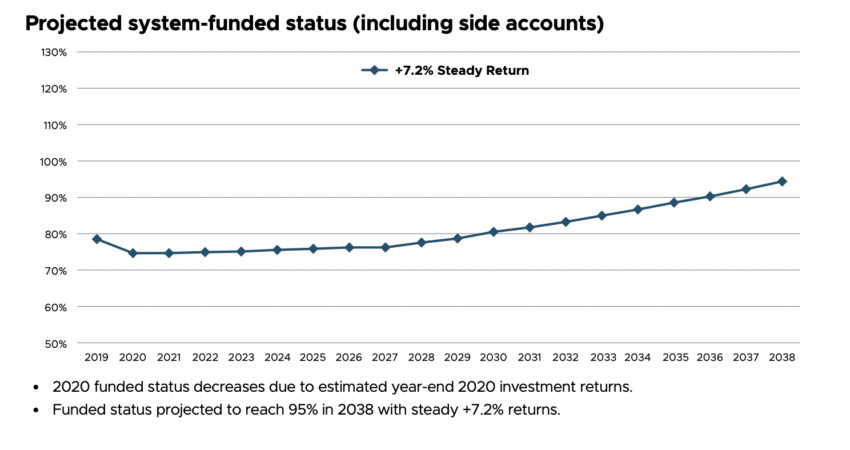

And the right wing’s quest for a 100% fully funded plan that will raise the cost of government – and provide a gift from Oregon taxpayers to Wall Street, the private equity firms that get their fees from managing the reserves, and their lobbyists – is doing fine. The downward blip shown in the chart below does not include the market recovery after the Spring market drop. The S&P ended the year up 18%. PERS will be fully funded in 20 years, probably less:

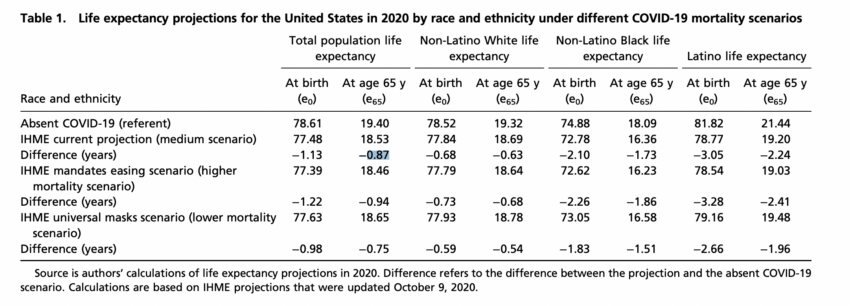

And that’s before the latest good news (for PERS and Oregon taxpayers). Covid-19 will reduce life expectancy for 65-year-olds by an estimated 5%. (PNAS paper here.) This will of course reduce the unfunded liability even faster, as PERS annuity recipients die off without collecting the full value of their pre-Covid calculated annuities:

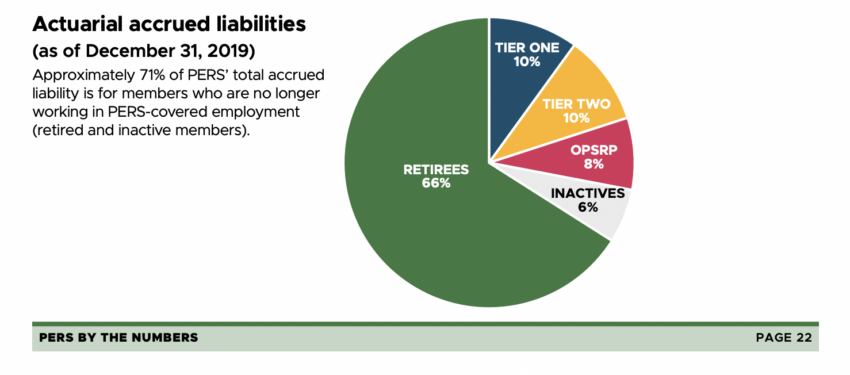

UO should see even larger reductions in its PERS contributions, due to a fluke in the formula for getting the system to 100%. As high-paid older Tier 1 faculty retire, not only does UO no longer have to pay into PERS for their salary, but the state reduces UO’s share of the cost of building up the cost of the systems unfunded liability for past retirees like Belotti. That cost – not the cost of providing retirement for new retirees – is about 66% of what UO now pays to PERS:

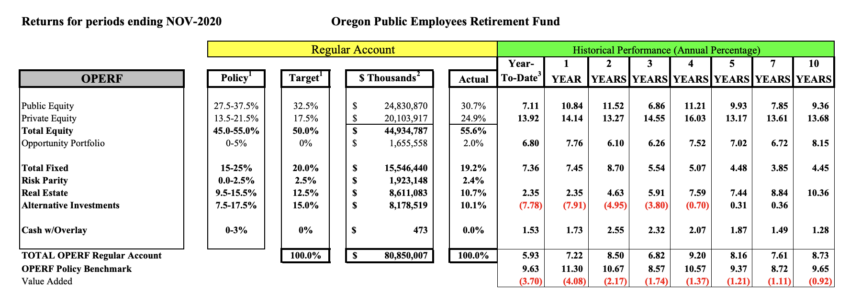

The part of this I don’t understand is how PERS continues to earn less than its benchmarks, year after year. Don’t get me wrong, they do way better than Paul Weinhold’s UO Foundation. But, given year after year of missing your benchmarks by 1%, wouldn’t you just fire your advisers, abandon active management, and put the money in the benchmarks?

From what I can see the poor performance and fees of active management is enough to account for almost all of the current unfunded liability. But I’m just an economist, so any explanation would be welcome:

I’m not as sanguine about PERS as UOM, but I think there are some important points here. Yes, PERS perennially underperforms its benchmarks, by quite a bit. It pays handsomely for this to “investment experts.” You would think there would at least be some inquiry into this by the legislature, the governor, what’s left of the press in Oregon. Maybe there’s a reasonable explanation, but shouldn’t responsible people be raising the question?

Here’s another thing. The pension fund is only partially invested in the stock market. This is good when the markets are bad, as in the Great Recession for a while; but terrible when the market is roaring or just doing well, as it is more often than not. One of my nephews is a Tier 1 ORP (optional retirement plan) fat cat professor, and he has all his retirement money associated with UO in TIAA in market index funds. He is far outperforming PERS, like by a factor of 2! And this is pretty long-term. He is so glad he is pursuing this strategy on his own. (His uncle sat down with him once with a computer and a web browser for about a half hour and explained all this.)

Warren Buffett, who arguably knows more about investing than the people at the UO Foundation or PERS, has said, as I recall, that state pension funds should put their money into low-cost stock index funds. Higher long-terms returns, low low management costs. I don’t know if any state has tried this. They would be a lot better off if they had.

I have taken every opportunity offered by the UO to put my hard-earned employer retirement contributions into personally owned funds at TIAA, and I have never regretted it. The investment performance of funds managed by PERS has always been underwhelming.

comparisons are hard and they are sensitive to what time periods you analyze. I too have funds at TIAA from working at other Universities. In my own case I can not say that over time (30 years) TIAA is better than Pers. During say 5 year intervals I can find times where TIAA does outperform pers. Of course right now, in the last two months, I have made significant gains in market index funds but I suspect they will go down the shithole pretty soon .. the entire is a crap shoot and we do need better

stability. Really the best example of that stability, while bad for the State of Oregon was, prior to 2003, the guaranteed 8% return on PERS. This is why most people hired in the 70’s and 80’s are happy old people now … since I never was a happy young people I look forward to that eventuality

Dear UOmatters

One comment – your series about PERS etc over the years has been mostly well done and based on real data. But, the IAP fund distribution is now starting its 17th year and the state made strong recent changes to how that fund is handled (basically making it less susceptible to market volatility), and hardly anything in this forum is ever mentioned about IAP – some faculty I have talked to said they had never heard of the IAP program – even though they have been participating in it since Jan 1, 2004. So perhaps some space to the present state of IAP and its evolution could be devoted to better inform readers as they approach retirement.

So in my own case, when I started receiving PERS pensions that was equivalent to about 62.5% of my TAKE HOME salary compared to UO Take home. Take home is important here since Medicare and SS are not taken out of PERS pensions so that’s 8% gain right there.

I choose to take by IAP funds distributed very 5 years that made PERS + IAP = about 87% of my take home salary.

So, bottom line, I think IAP should now be factored into any PERS discussion here – it’s relevant

Thanks, good point about the take-home pay and the IAP. It’s not immediately clear to me whether or not the 50% number includes IAP payments. I do know the legislature and courts are now letting PERS take some of the IAP money and use it to prop up the main account. One good source of info is the acerbic Dr. Fearless at the irregularly updated PERSINFO blog at http://persinfo.blogspot.com/

Yeah Dr. Fearless doesn’t have a lot to say about the IAP – for most of us, it doesn’t have a “lot” of money in it compared to PERS (which is why I took it out for 5 years) but it is starting to become

more significant.