The most recent comprehensive report on Oregon’s Public Employees Retirement Plans is “PERS by the numbers“. The numbers are a bit out of date, but the basics are clear.

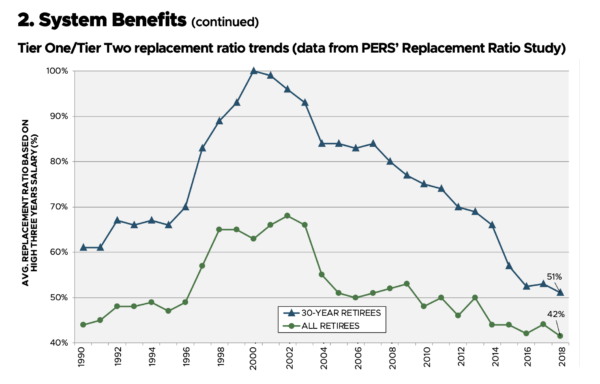

1) PERS is no longer the gravy train it once was for state employees. Current retirees with 30 years service retire with 51% of their final pay:

2) As of March 2020, PERS had a reserve of about $75B invested in private equity, stocks, bonds, real estate etc. A lucrative business for Wall Street.

3) PERS is paying out about $4.6B in benefits a year to retirees:

4) In 2018, state agencies, municipalities, school districts, universities and community colleges, fire districts, etc paid $2.4B into PERS. The average rate currently is about 30% of payroll – a huge expense. (About 2/3 of employer contributions go to building up the PERS reserve. PERS investments paid for the rest of retiree benefits. From PERS by the numbers.)

5) The state’s revenue forecast will not be out until May 20th, but it’s not going to be good, and Governor Brown is expected to call for about $3B in spending cuts for the 2 -year biennium budget that began July 1 2019. According to OPB, these cuts might include such things as:

Agency proposals available Tuesday morning include shuttering most Oregon prisons, steeply narrowed state police activity, elimination of financial aid to thousands of Oregon students, and drastic reductions to some of the state’s safety net programs.

… The Oregon Department of Education is mulling cuts of nearly $730 million to its $8.6 billion general fund budget, including a $636 million reduction in funding to school districts around the state.

6) Instead, Oregon could simply declare a holiday on state payments into the PERS reserve fund. PERS payments to current retirees would come out of the reserve fund, which is among the largest in the country in comparison to the actuarial liabilities.

A 50% holiday would almost be enough to eliminate the need for cuts – but why think small? Let’s just stop paying in for a while. $75B is a hell of a rainy-day reserve, and it’s really coming down out there.

7) But won’t future future taxpayers have to foot the bill – or future state employees, in the form of lower wages? Yes, so long as PERS insists on getting to a 100% fully funded plan, instead of running on a pay-as-you go basis like, say, Social Security and most other states are doing on a de-facto basis.

But even if they do have to pay to get the Wall Street reserve back up to 100%, those future people will be a lot better off if the state still has functioning schools, universities, and, I suppose, prisons. And Oregon’s economy will be better off with state employees who are working, and spending their paychecks at local businesses.

Wall Street doesn’t need this money like Oregon does.

you gotta stop with these reasonable and thoughtful solutions. ½ price VPFA in your future??

Consider this as my application to be your chief economic adviser, when you run for governor.

Do it! But the only thing which makes the old timers angrier than messing with Tier I/II PERS, is not giving them parking. So just make sure there is parking in your plan.

My plan includes a double-wide spot for every Tier I/II retiree – as an incentive to retire, and for the good of all except perhaps auto body shops.

This Tier 1 employee would glee fully retire ASAP — IF PERS insurance was *included*. Many of us eligible to retire under Tier 1 cannot because we need the PERS insurance as we are not 65 yo yet. We can’t survive on the PERS $ and pay insurance premiums out of it. If the UO would make a such a deal, I’ll bet they’d get a lot of takers — especially classified staff.

If you listen real closely, you will hear the collective harumps of Wall Street bond palaces after they get wind of this notion…

In a union home, I was raised to sincerely hate recurring ‘raid the pension fund’ cries that come up every time there’s a budget hiccup. But something has got to be on the table now.

PERS Tier 1 – 3 high years salary, OT, accrued sick leave, accrued vacation, sometimes key person insurance and car allowance “money matched”. Is it really a retirement of average of 51% earnings? I don’t think so. I think it is a fiscal black hole, or being real about it, let’s just call it a Unicorn. At least think about it before you put the system even deeper in the hole.

A truly stupid idea. What do you think happens to all of that cash sent to retirees? [UOM: remainder of comment deleted because commenter obviously didn’t read or understand the basic point of the post.]

You’re basically proposing something like mortgage forbearance.

The real revenue shortfall , including lottery, should be about $4.1 billion or 17% of close of session revenues.

The upcoming June Federal bailouts to states might net $1.5 billion, rainy day funds about $1.3 billion so the gap is plugged with a PERS holiday and stealing cash from dedicated fee fund balances.