Ted Sickinger has the story in the Oregonian here:

Employees hired after Aug. 28, 2003 who make more than $30,000 a year are now sending 0.75% of salary to support the pension fund, with the remaining 5.25% of salary still flowing to individual accounts.

The employee cost-sharing is expected to offset about $300 million in employer contributions statewide. It is expected to reduce employees total retirement benefits by about 1% due the the reduction in ending balances in their individual accounts.

The impact of Senate Bill 1049 falls mostly on longer-term employees, as well as those at the very top of the state’s pay scale.

The law redirected a portion of the required retirement contributions that employees make to an individual, 401(k)-like account that supplements their pension benefits to support the pension fund.

Employees making more than $30,000 a year and hired on or before Aug. 28, 2003 are now required to send 2.5% of their salary to support the pension. The remainder of their required retirement contributions – another 3.5% of salary – will still flow to the individual account.

This seems confusing, but what is actually happening is simple: PERS is reducing the amount of money that goes into employees’ individual accounts and putting it into the overall pension fund, so that the state (and school districts, universities, etc) can reduce their own payments to that fund, and the supreme court has now decided that’s OK.

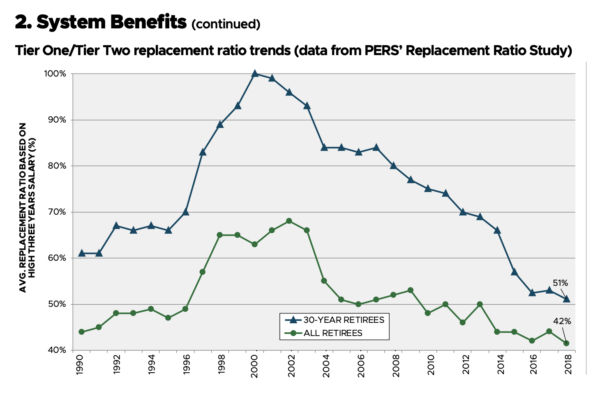

For more see “PERS by the Numbers” here. For those who remember how generous PERS was to people like Lorraine Davis and, famously, Mike Bellotti, it may come as a shock to see that the average 30 year retiree is now barely getting 50% of their final salary:

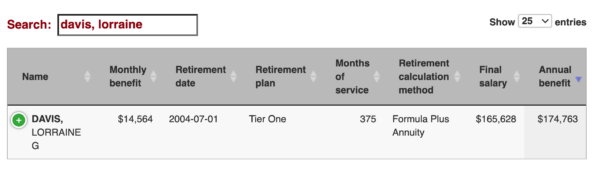

For example, Lorraine Davis, who retired in 2004, has been getting more than her final salary ever since:

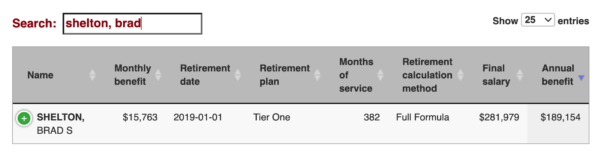

While Brad Shelton has to scrape by with only 67% of his:

The Oregonian’s database of payouts is here.

The key point (from the article): “the Legislature is entitled to change employee retirement benefits prospectively, for future service, but benefits earned on service already rendered are sacrosanct.”

On the one hand, this relieves some of the pressure on the system. On the other hand, of course, it encourages the legislature to see what else they can take back from us. For example, the ruling essentially “pre-approves” the legislature raising the amount paid by employees up to the full 6%. There is nothing sacred about the lower percentages adopted by the legislature; the legal principle would be exactly the same.

But it would appear this decision does not do anything to undermine important elements of the retirement system for those in some of the early tier programs, like the money match.

At this point in time, I doubt there is a single Tier 1 employee left that would be better off choosing the money match

For those that left PERS to enter the ORP in 1996, the money match will offer the better deal (though as noted above there were more cons than pros from this decision, as it turned out). If someone stayed in PERS, you may well be right.

I haven’t been able to figure out if this applies to people in the ORP.

I don’t think so, we’ve already got the short end.

So the Supreme court has to carefully consider the legality of cutting benefits that were unintentionally far too generous and there won’t ever be enough money to pay it all because of mistakes about inflation forecasts, but the university can easily cut pay our because revenue has temporarily fallen.

Why???