Saul Hubbard has a summary in the RG here, and the economists’s report is here.

The bad news is expenditures, particularly PERS. The state seems hell-bent on getting from the current 70% to 100% fully-funded within 20 years, no matter how much damage that does to the economy. Why not use the $70B in reserves to smooth out the transition over a more realistic 50 years? How did Oregon’s government get to the point where we’re letting an arbitrary accounting rule cause so much pain? The report from the PERS accountants is here.

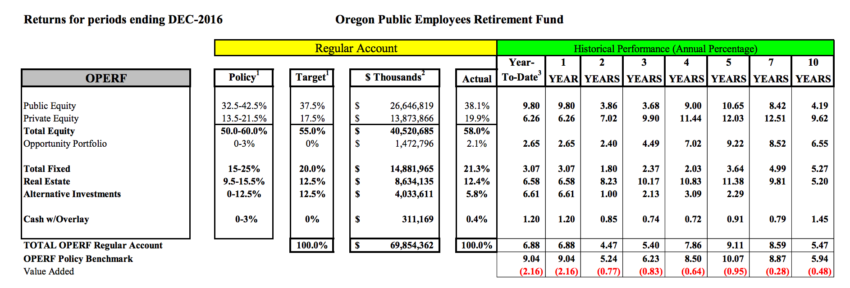

Contributing to the PERS problem are the unusually low investment returns. How do the finance guys fail to hit their policy benchmarks year after year after year?

Is the argument for paying it off that we don’t saddle future generations with this debt?

The counterargument for me, is funding PERS at the expense of funding education is robbing for future generations in an even greater amount. Especially those that can’t afford private schooling or out of state tuition.

The future generations will be robbed either way. By doing it this way, it is visible to all involved and there’s a chance to change that path. By accepting the status quo of funding, you hide the problem until all the Tier 1 recipients are dead and then you can’t claw that money back.

If by “then you can’t claw that money back” you are suggesting that it CAN be “clawed back” by trying to renege on the Tier 1 obligations — then I think you are engaging in more of the damaging thinking that brought about the 2013 PERS fiasco over COLA adjustments. The Oregon supreme court ruled unanimously against the state in that episode. They are very likely to do so again, if the state tries to pull another stunt like that. 70% of the current unfunded liability is due to already retired workers. They have a true, definite, unambiguous contract with the state. There is no way the state is going to be able to renege on that.

Usually the person insisting that a contract can’t be violated is the person benefiting at the expense of others. Supreme court decisions can be overturned or invalidated by constitutional amendments. The narrative that we have to pay on a contract that will destroy the state is the one damaging thinking.

I find it amazing that the same old doom and gloom that revolves around PERS, never touches on the destruction created by State and local tax breaks. They give away the money to pay their obligations and then blame the workers for the mess they created.

Why no uproar over the lack of utility from these tax breaks?

1) Federal pension law may come into play here. If the unfunded liability goes above a certain percent, I believe much more draconian IRS rules on required contributions come into play. I believe that is if the funded level goes below 60%. I am no expert on this, however.

2) Personally, I do like the “extended payment plan” idea. OUS has already issued pension obligation bonds which add about 10% to the funded level. It also adds to the liability — the bonds have to be repaid — but at least there is a clear path to funding the obligations.

3) It is kind of silly to try to predict what market returns are going to be over 10, 20, 40 years. Who predicted in 1980 that there was going to be a 20-year stock market boom? Well, OK, maybe a few Reagan supporters …. Who predicted in 1999 that there was going to be a market funk that would last through 2017?

For all anyone knows, there will be a Trump market boom that will wipe out the PERS liability. It would drive a lot of people insane. If he doesn’t get impeached first. But who the hell knows?

4) Regarding PERS not meeting its benchmarks — yes, that is very striking, isn’t it? Does it really mean what it seems to mean, that PERS is underperforming? I don’t know what it means. But PERS spends, from what I can tell, about a half billion per year on help to manage its assets of about $70 billion. That’s about 0.7% per year. Not chicken feed.

I believe that Warren Buffett has recommended that public pension funds use very low cost index funds in a small variety of types of investment vehicles — stocks, bonds, emerging companies, etc. The idea being that this usually beats “active management” by supposed market experts.

It’s interesting that a lot of small colleges are beating Ivy League endowment returns by following just this strategy.

It’s too bad that there is so little constructive thinking about PERS on the state level that is outside the box, or even just a little imaginative, like the above.

Instead the talk is all about trying to renege on the current PERS obligations, i.e. screw the retired or about to be retired Tier 1 workers (very likely illegal); screw current workers to pay for the liability (counterproductive when you’re trying to hire good workers); raise taxes; or savage public services, e.g. schools.

Not so sure it’s the Tier 1 PERS (or other PERS) retirees that are getting screwed, but perhaps the taxpayers who are funding a program – created/modified over time by a legislature, a public employee heavy PERS Board (historically) & a judiciary – that includes:

1) 7% guaranteed (RISK FREE) return (Tier 1)

Note: During the unprecedented stock market boom from 1979 to 1999, a PERS board that was stacked with public employees voted to credit most of the system’s excess earnings to member accounts. During that two-decade span, returns averaged 15 percent a year and the PERS board credited employee accounts 12 percent, on average. (Why build reserves for a rainy future day when you can plunder today??)

2) annual retirement benefit that exceeds the original goal of 45-50% of final average salary (FAS), including social security, after a full career to an average of 77%, NOT including SocSec, for those with 30 years and 53% for ALL retirees in PERS (according to 2011 PERS: By the Numbers Report)

3) FAS calculations that allowed retirees to include value of unused sick leave (and of course, public employees could rack up that time over many years as there was no “use it or lose it” requirement)

4) employer funding requirement that went from 40% of FAS to 50% to 60% to 100%

“Since 1971, PERS laws have been made exclusively by legislators who were or who could become PERS members and since 1984 every PERS lawsuit has been decided by judges who were PERS members. Today, no PERS law can be made or changed without the consent of PERS members. While PERS members are entitled to a seat at the table when PERS retirement benefits are being decided, they are not entitled to every seat at the table. But that is what PERS members have had since 1971.”

So, the taxpayers got screwed and now are being extorted a la – keep paying or else. As for revising the terms of PERS, I think taxpayers can argue unconscionability – a doctrine in contract law that describes terms that are so extremely unjust, or overwhelmingly one-sided in favor of the party who has the superior bargaining power, that they are contrary to good conscience. Typically, an unconscionable contract is held to be unenforceable because no reasonable or informed person would otherwise agree to it. Who in their right mind would agree to such a package where all the cost and risk is on the taxpayer and all the benefit is with the PERS retiree?

References: http://members.pdxcityclub.com/HigherLogic/System/DownloadDocumentFile.ashx?DocumentFileKey=1e167e4d-3284-41d4-b2ae-490df8b9a65a; http://www.bendbulletin.com/localstate/5067705-151/pers-9-myths-about-oregons-public-pension-fund; http://cascadebusnews.com/problem-oregon-pers/; https://en.wikipedia.org/wiki/Unconscionability

You may say that “no reasonable or informed person would agree” to the terms for PERS Tier 1 members. But the terms were established over many decades by legislators and governors from both parties. The Oregon courts have ruled that the terms have the force of a contract. Actual Tier 1 retirees have an actual contract with the state.

In the last round the attempted “reforms” were shot down by the Oregon supreme court 7-0. You might argue that the judges are all corrupted by being in PERS themselves. But then it might be kind of hard to explain why the legislators, who are also in PERS, voted to cut benefits, leading to the court challenge and ruling. And it might be kind of hard to understand how the judges have ruled against public workers on pension matters on several bitterly contested occasions.

One can argue about who is getting screwed, in the past or prospectively. As I suggested nearby, I think that this has become rather unproductive. I don’t think the Oregon courts are going to allow much clawback on pensions for past work of future retirees. Much less pensions for past retirees.

The argument that PERS is “destroying the state” as some people say is pretty unconvincing. The state recently chose to greatly expand Medicaid. To greatly expand vocational education. To reduce corporate taxes (in 2013, as part of the “Grand Bargain” that led to the last PERS debacle). The state seems to be rolling in dough. I don’t think the court is going to let the state off the hook for PERS. Certainly, the state is not remotely near “bankruptcy,” a concept that doesn’t exist in law for states in any case.

Again, all the stale proposals are probably going nowhere. What do you think of my suggestion (following Warren Buffett) to reduce PERS trust fund management costs and increase return by moving away from trying to beat the market, toward low-cost index-type funds?

Do you think there is any hope that the country will return to economic health, so that the financial markets can fix the problem? Or is the “American dream” permanently over?

I think the court battles could continue past the borders of our state. And, fundamentally believe that reasonableness should inform such proceedings, in a fashion similar to recent California Appellate Courts who ruled that state lawmakers may alter retirement benefits for current employees. They said workers’ pension rules may be changed during their careers so long as they still receive “reasonable” benefits. If the California Supreme Court affirms such decisions, I think it’s very possible that a US Supreme Court would rule the same.

The question of what constitutes a “reasonable retirement benefit” should be asked. I doubt many of the state’s 4million plus residents/taxpayers would think a benefit that provided retirees 50-60% of their average salaries (after at least 20 years) to be insufficient/unfair. I think most would find that to be extremely generous. I think most would believe that incorporating better fund management practices would be wise, as you/Buffett suggest. As it would be wise to have employees covered by PERS, contribute more directly (i.e., from their own paycheck) and share more risk in the investments from which their benefits are derived. They would also not want a bunch of rules and tricks made up (e.g., adding sick leave time to calculate FAS).

According to a pretty comprehensive study by the American Enterprise Institute which looked nationally at public vs private employee compensation, Oregon public sector workers receive a premium above comparable private sector workers (+13% – page 67). I can see no reason for this to be the case. Can you? Here I might add, paraphrasing Sinclair’s famous quote, that it’s difficult for a man to understand something when his economic interest depends on him not understanding it.

ref: https://www.aei.org/wp-content/uploads/2014/04/-biggs-overpaid-or-underpaid-a-statebystate-ranking-of-public-employee-compensation_112536583046.pdf

Given your ad hominem insinuation in your last sentence, I think I will forego further engagement with you.

Instead, I suggest you take your novel and dubious legal theory to the Oregon supreme court.

Lots of luck.

P.S. Oregon is not California.

honest Uncle Bernie – sorry if you are offended. I am just stating what appears to be a clear factor in many discussions about PERS, especially TIER 1 retiree benefits. Folks who are getting this deal know just how sweet it is (as evidenced by the subsequent reforms/self-preservation of the system in Tier 2 and OPSRP). Therefore, it’s quite reasonable that self-interest can make it hard for those getting this deal to recognize that perhaps it is, in fact, an unreasonable retirement benefit and therefore should be reformed. So, again, sorry if you took this observation as a personal attack.

I am on Tier 1 and yes I think it is a relatively unreasonable set of terms, compared to other retirements. However, as in all things, context matters:

1. I ain’t gonna give it back …

2. Many UO faculty that have retired from the UO were originally hired at a time of extremely low salaries (less than 25K for assistant prof for instance) and some took that job because of Tier 1 promise.

3. The Tier 1 situation really makes the biggest impact in terms of many pension years such a retiree actually lives. In my own case, I will have to be on PERS for about 33 years to equal the gross salary made at the UO over a shorter time period. You can decide for yourself whether that is fair or unfair. For me, it just is …

Dog, I appreciate your candor. I, too, would probably feel similar if I was in your shoes which is precisely my point. It’s easy to believe that one’s own “gains and good fortune” have been earned and are justified.

What seems reasonable to me is that a PERS retirement benefit replace a “fair” proportion of a retiree’s salary (say 50%), as I’m assuming there was nothing preventing such a retiree from seeking employment elsewhere during their working years nor was there anything that precluded them from saving independently for their retirement (and doesn’t account for what they will receive from social security). Of course, there would be specific costs/benefits associated with changing jobs and/or saving independently – which is as it should be. Capturing significant reward without any risk smacks those who are obligated to pay (taxpayers) as very unreasonable and unfair. As it stands, Oregon will continue to pay an outsized debt to the past, which will negatively impact its future. But, PERS Tier1 retirees probably need not fear losing anything.

Dog, I think it’s generally true that the reason public employee pensions are in the hole right now is exactly because legislatures habitually put off the inevitable by offering crappy salaries in exchange for good pensions. But was $25K really a low starting salary? The CPI calculator says $25K in 1980 is like $74K in 2017, which sounds about right.

Public pension unfunded liability is really a national issue. There is over 1 Trillion dollars of it floating around. I feel all the existing, current and future PERS beneficiaries may be impacted by a Supreme Court ruling on what constitutes a reasonable pension and what adjustments can be made prospectively. Call it claw back, but the Oregon Supreme Court has it wrong. Feel free to google the California Supreme Court which will be ruling on the “California Rule” for pension which Oregon is one of 12 states follows. It says that a pension promise is forever, however, the California Court is now looking at if this is true. If it doesn’t go their way, expect California public unions to sue to the Supreme Court, in which case Oregon would be affected. Feel free to give me negative votes! Eventually, this will be solved, some state in a worst condition of funding won’t have to go bankrupt, and folks will get reasonable adjustment to their pensions.