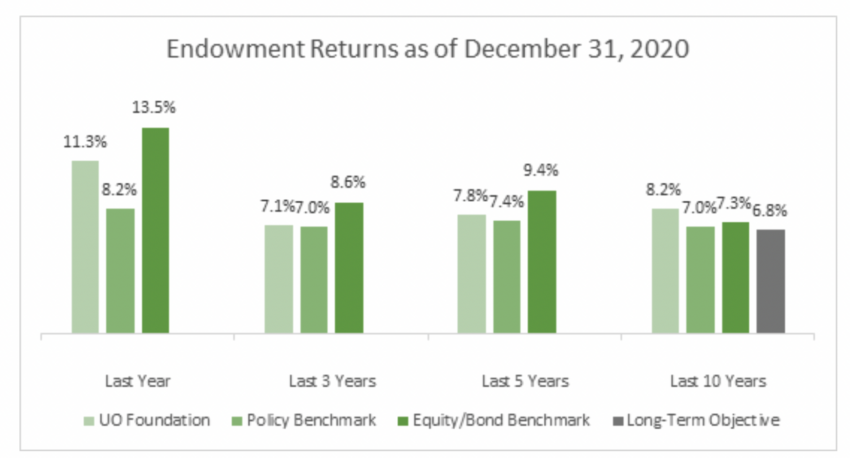

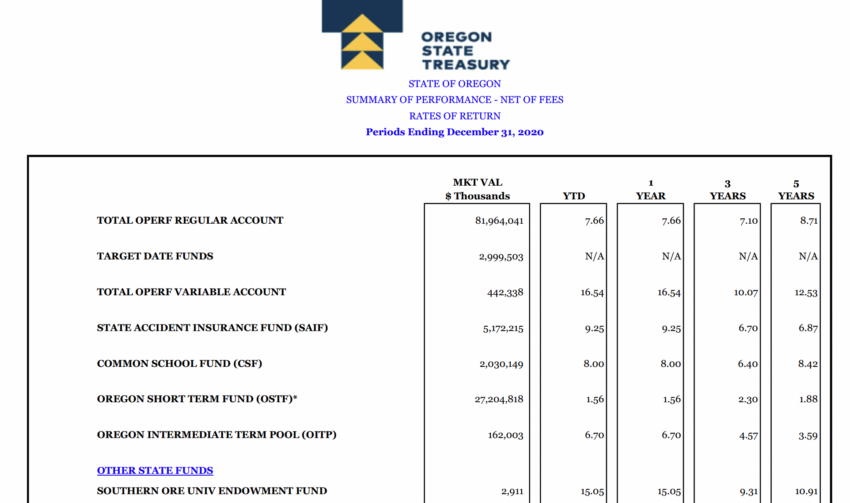

Over the past 5 years Southern Oregon University has earned 10.9% on its endowment, after fees. UO has earned 7.8%. What’s SOU’s secret? While UO has been paying out the butt for Foundation CEO Paul Weinhold and his investment expert Jay Namyet, SOU just left it up to the Oregon Treasurer, who apparently put 60% in the SP500 and the rest in bonds, as one would do.

Back of the envelope, Weinhold and Namyet have cost UO and our donors about $150M over the past 5 years – while pocketing about $5M for themselves, according to the IRS 990’s.

Namyet is finally retiring – it’ll be a year or so before Weinhold has to make his buyout cost public on the next IRS 990 – and is being replaced by an even more expensive looking option, as announced by UO’s PR flacks on Around the 0:

More on the UO Foundation’s troubles here.

S&P can also tank 30% in a month so there’s that.

Unfortunately, what UOM reports is probably all too true. The same pertains to most state pension funds, including Oregon PERS. They lose tons of money trying to do what is known to be very difficult, if not impossible: beat the market.

Warren Buffett famously (but not famously enough) advised a few years ago that state pension funds put all their money in stock index funds, as I recall. (There may have been a bond component, I don’t remember). The idea being avoiding fees and also the losses that come with thinking that you are the one clever enough to outfox the market.

It’s true, as a nearby poster says, that the stock markets can tank. The rejoinder is that over the long haul, they give the best return. States (and endowment funds) should play the long game.

One would think that someone would be on top of this (besides UOM). The pres? Trustees? The state? Eugene Weekly? I give up!

The firm that is managing the endowment has a few Phil Knight connections. The firm’s founder contributed to the OHSU cancer challenge. A senior advisor formerly served on Nike’s board.

https://www.oregonlive.com/playbooks-profits/2015/07/phil_knights_swoosh_stock_team.html

https://news.ohsu.edu/2015/06/25/ohsu-sets-fundraising-record-by-meeting-1-billion-challenge-from-nike-co-founder-and-wife

https://www.jasperridge.com/team/senior-advisors/a-michael-spence

Thanks for the links. I wonder if Jay Namyet’s retirement is related to the Arena bond reserve scheme – seems like he should have known the rules.

I think we should start a student club where they pretend to have the UO endowment, perhaps we event fundraise a small equivalent (lets say 1,000 per team).

Then every year we see how the teams do relative to the “experts” charging huge fees.

Or we could have a contest where each student team pays for a few rounds of golf with Weinhold, topped off with dinner at the country club to talk sports and brag about their business connections, then he decides who gets the contract.