10/27/2020 update: This is very strange and troubling. (Full disclosure: I’m just an economist, not a finance professor or auditor, nor am I a UO Board of Trustees member charged by state law with a fiduciary responsibility to UO.)

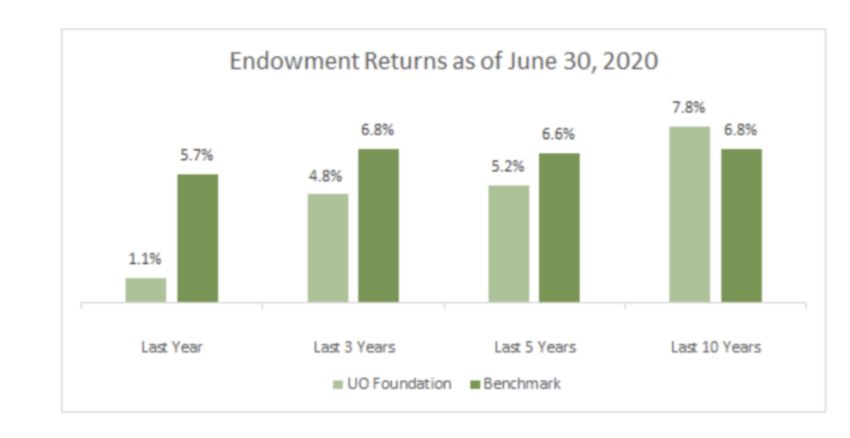

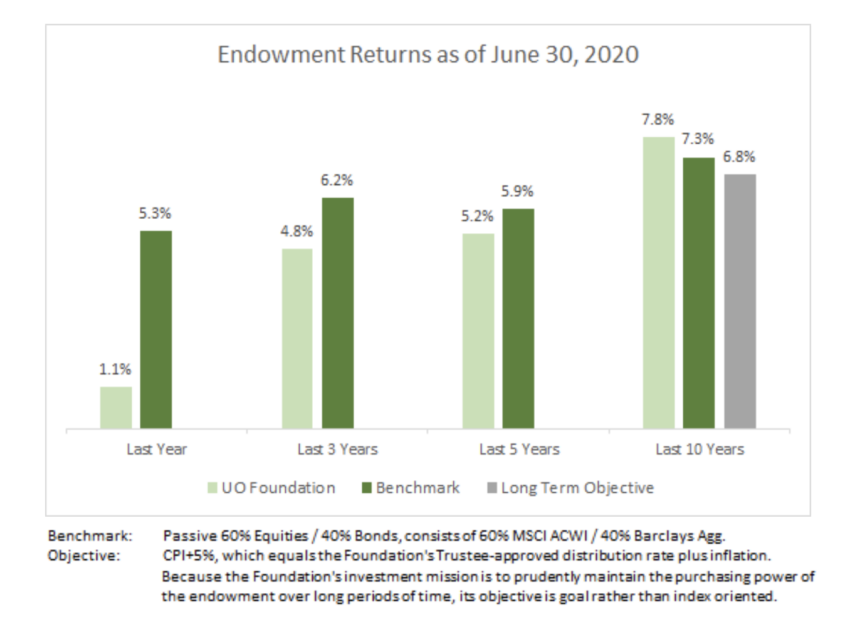

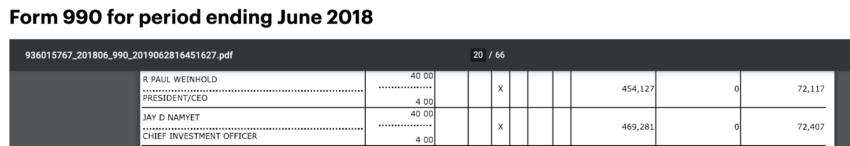

A month ago I put up the post below, centered around the UO Foundation endowment’s poor recent investment returns. Part of the post was the figure on the top, comparing the Foundation’s returns on its endowment with its own benchmarks. I got this from the Foundation’s website. The Foundation has now changed the information on its website, substituting the figure on the bottom:

Yes, you’re reading the numbers on those dark green bars correctly – don’t let the sneaky change in the y-axis scale fool you. The UO Foundation has retroactively lowered the 1-5 year benchmarks they use to compare their returns with.

The UO Board of Trustees – which includes many people with finance expertise, including Chair Chuck Lillis, who’s lost lawsuits about his past due diligence failures – meets on Thursday to hear from UO Foundation President Paul Weinhold.

The questions should be interesting. An obvious one would be “you including dividends in that gray bar?” Here’s hoping they don’t stop there.

9/23/2020: UO Foundation CIO Jay Namyet’s bad investment streak costs UO ~$50M

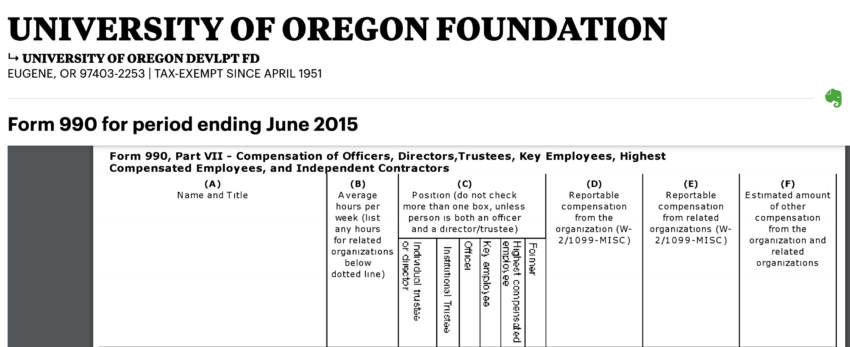

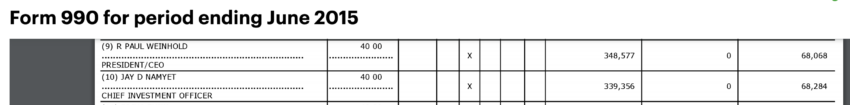

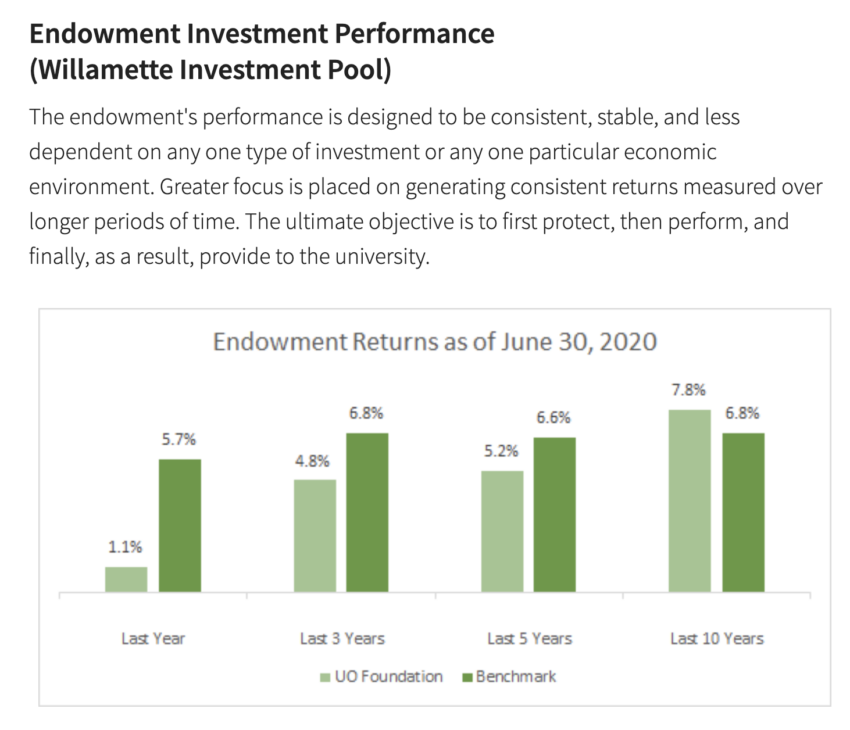

But it’s been good for him of course. From 2015 to 2018 – the last year they’ve released pay data – the Foundation trustees have seen fit to increase Namyet’s total compensation from $417K to $572K. Taking logs that works out to a 34% increase over 3 years:

Unfortunately for UO, his investment metrics have not matched these pay increases:

That’s down roughly $50M over 3 years, relative to the benchmarks. And, in an unusual exhibition of transparency from Foundation CEO Paul Weinhold that can’t bode well for Namyet, the Foundation itself is now admitting this:

The Foundation’s benchmarks are also low, and poorly defined:

“Because the Foundation’s investment mission is to prudently maintain the purchasing power of the endowment over long periods of time, its benchmark is goal rather than index oriented.”

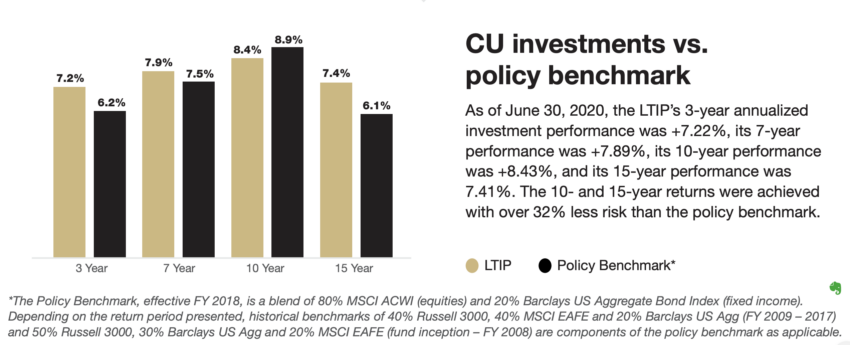

Compare this with, say UC-Boulder’s Foundation, which has explicit, higher benchmarks, and much better performance. For example, over 10 years CU’s benchmark index funds returned 8.9%, while the UO Foundation’s benchmark was 6.8%.

What went wrong at UO? I don’t know, but a guess would be that Namyet’s large investments in offshore private equity – including a long-term play in Alberta tar sands – finally started getting marked to actual market prices.

A previous post on Namyet’s nasty emails to the UO student CO2 divestment group is here. Given how much this has cost us, it seems trivial to cite The Three Amigos, but is it possible that Namyet was really angry about something else?

9/12/2016: The Emerald has the story here, and it’s on the UO Divest facebook page here. Back in April, Foundation CFO Jay Namyet was writing nastygrams like this to our students about their efforts to get the secretive UO Foundation to join the CO2 divestment movement:

Subject: RE: follow up meeting

Date: 2016/03/30 14:14

From: Jay Namyet <[email protected]>

To: [UO Divest undergraduate student]

[UO Divest undergraduate student],

No, indeed we did not. As I told you, based on your conduct, our dialogue was over. I hope in years to come you will appreciate a life’s lesson in this affair. That is what a university experience is all about.

Regards,

Jay

From: [UO Divest undergraduate student]

Sent: Wednesday, March 30, 2016 2:11 PM

To: Jay Namyet <[email protected]>

Subject: RE: follow up meeting

Hi Jay,

I know we didn’t end our last meeting on the best note, but we’d be happy to try and get a fresh start and meet again to discuss divestment sometime this term if you’re willing. Let me know.

Sincerely,

[UO Divest undergraduate student]

On 2015/04/09 18:30, Jay Namyet wrote:

Great, we are in agreement then, no more dialogue.

Sent from Outlook [1]

Correct me if I’m wrong, but it’s my understanding that the returns also include contributions. Given all the endowed gifts towards UO’s campaign things look less rosy.

It must be a stressful year to be in this business. I certainly do not have the nerves or stomach for this line of work.

Things could be a lot worse though. Speaking of Alberta: https://www.cbc.ca/news/canada/calgary/aimco-kevin-uebelein-jason-kenney-pensions-alberta-1.5552562

I’m 99.99% sure these returns do not include new donations, as they should not. On the other hand I’m pretty sure they do not net out the costs of Namyet and his crew, which they should. It’s disturbing that the Foundation does not define Namyet’s benchmarks here. Maybe they are available somewhere? Paul, if you’re reading this please post them, preferably without having your lawyers send me another defamation threat.

Thanks. I was looking at NACUBO tables, which track size but not market returns.

No worries, I’m sure Chuck Lillis, Angela Wilhelms, and their crack team of UO Trustees will get to the bottom of this and explain it and the Foundation’s weaselly statement that “Because the Foundation’s investment mission is to prudently maintain the purchasing power of the endowment over long periods of time, its benchmark is goal rather than index oriented” at their Dec 3-4 board meeting.

Jack Bogle is dead. Long live Jack Bogle!

I believe Warren Buffett has advocated that public pension funds stop paying big money to try to outfox the market, but instead put their money into low cost index funds.

Perhaps university endowments would be wise to do same.

So what you’re saying is they should use some of the zebra fish in the biology lab to pick investment porfolios instead right?

Over the 10 years shown by the Foundation, the S&P with dividends reinvested averaged 13.7%. AAA bonds averaged 5.07%. The standard 60/40 mix averaged 10.3%. Namyet was only able to get 7.8%. (All nominal, as the Foundation’s table seems to be). If we’d given the zebrafish say $250M in 2010, with 60/40 we’d now have $664M, while Namyet would have only given us $529M. So those would have to be pretty fucking well-paid zebrafish to do worse for UO than Namyet has done.

Data from https://dqydj.com/sp-500-return-calculator/ and https://dqydj.com/investment-grade-corporate-bond-return-calculator/

Can somebody point out that this type of waste will strongly discourage Phil Knight or other mega donors from giving ever to the general endowment. They don’t want to make Namyet rich.

Same for any other mega donor. And they’re smart and careful enough to do due diligence and realize giving to the general endowment is just making that asshole rich.

I find this sort of thing literally incomprehensible and likely fraudulent. Any Bogle schmuck could easily beat the Foundation’s record. The Willamette Investment Pool statement is vacuous. And this, too, is senseless: “Because the Foundation’s investment mission is to prudently maintain the purchasing power of the endowment OVER LONG PERIODS OF TIME, its benchmark is goal rather than index oriented.” And what, again, specifically, is that goal and how do you know whether you have reached it? And, then: this is as opposed to “imprudently” maintaining purchasing power over long periods of time? And what are “long periods of time” as opposed to short ones? “Purchasing power?”

(UOM hits on this above. I am not a maths person so this may be wrong.)

ORP allows us to use Fidelity that has TISPX which is a low fee S&P index fund. Over the past 10 years while the foundation has a complete BS “long term goal” to return 6.8%, our retirement fund has returned almost 14% (13.91)

https://finance.yahoo.com/quote/TISPX/performance/

Therefore, we pay the foundation to try to under perform by 7% PER YEAR!!!!

To put some real numbers to this, lets pretend that Uncle Phil actually put $200M in an endowment 10 years ago: the foundation “long term goal” of 6.8% would return $186 MILLION DOLLARS…

Not bad; however, had they just stuck it in our ORP retirement fund, a low fee index fund, would have returned over !!! HALF a BILLION DOLLARS !!!!

($537 MILLION)…

I am not sure what that that is in Gotts, or GTEs, or Tenured faculty, but I think it would easily pay for a few phildo’s and jumbotrons, perhaps even a couple PK parks or joxs in the box.

And if the hat, Frohn, Gott, or any other president who had a SUCCESSFUL ONE BILLION DOLLAR!!!! campaign, and actually deposited that money in the equity fund we could have about…

$3.7 BILLION DOLLARS! for each successful campaign.

Someone is getting screwed here: Uncle Phil (as a placeholder for all donors), the BOTs, the state, the institution, or the students? … but not the foundation.

UO endowment hits $1.2B. The market value of the fund grew 30% YoY. Not a bad return, but when you consider all the endowment gifts and the overall stock market it is pretty average.

Hopefully the managers are well positioned for the coming crash…

https://www.uofoundation.org/s/1540/images/editor_documents/financial_statements/final_audit_report_with_foundation_annual_report_-_fy21.pdf