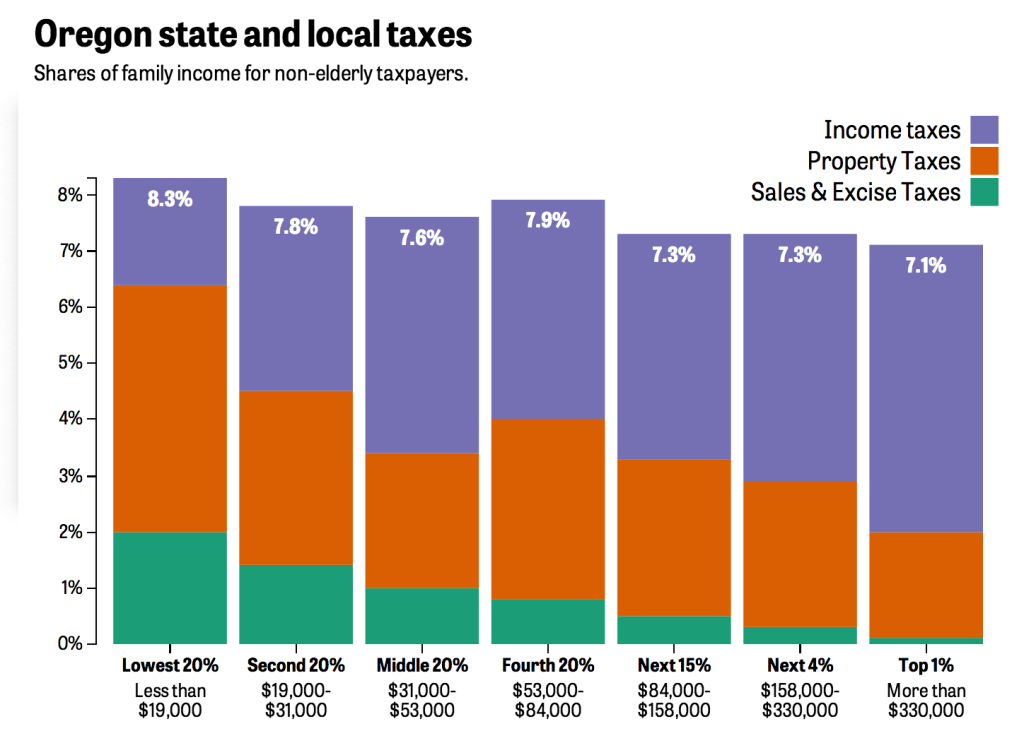

This is driven by Oregon’s reliance on income taxes rather than sales taxes and by the Oregon EITC. (We have the unlikely combination of Milton Friedman and Richard Nixon to thank for the federal EITC, which gives low income families a tax credit for income they earn through work. Oregon’s EITC provides a small supplement to the federal program. The EITC is a much better way to boost income for the poor than a minimum wage, because it doesn’t increase employment costs and unemployment, and it can be targeted to workers with families. Kitzhaber’s “grand bargain” included a modest increase in the Oregon EITC.) Christian Gaston has the story in the Oregonian. The data is from the Institute on Taxation and Economic Policy.

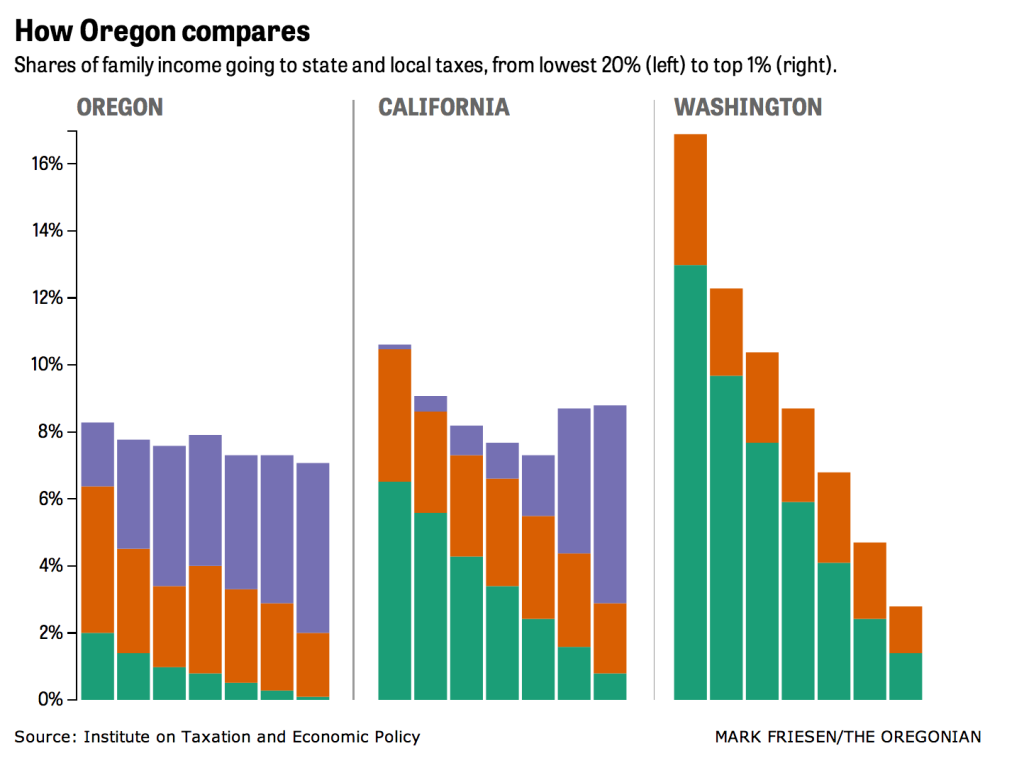

I wonder if it’s just a coincidence that Washington attracts so much entrepreneurship, is consistently rated one of the best states for business, has far outdistanced Oregon in per capita income?

And are they a magnet for the homeless like Eugene and Portland?

Yeah, Oregon’s graph is very different from Washington’s, which as you say is very attractive to entrepreneurship. Oregon and California (which has a graph much like Oregon’s) should change their tax rates, since both Oregon and California do so poorly at attracting start-ups. You’d think the Bay Area would do a better job at attracting start-ups with its nice climate and all, but good luck to them pulling entrepreneurial types away from Seattle!

Actually, scienceduck, by many indices California is in big trouble business-wise. The state seems to be living off past glory and riches — the way New York did long into its long long slide. Do you remember when the “Empire State” had the largest population? When New York City had a quarter of the Fortune 500 headquarters? When places like Buffalo, Rochester, and Syracuse were vibrant cities? Most people who are not old enough cannot even imagine what New York was like.

Even California’s vaunted higher education system may be in big trouble. Certainly the prospects for the University of California do not look as bright as they once did. I don’t think Caltech is what it once was. Admittedly, Stanford is doing great and probably will for the foreseeable future.

I think the perception that California still attracts entrepreneurial activity is valid. What are other startup hubs? Hmmm… this list puts Seattle at #5, and what’s this? Portland, Oregon at #11? http://www.businessinsider.com/hottest-startup-cities-2013-9?op=1

Anyway, cultivating new businesses is complex, and I disliked the first commenter trying to pin it all on tax policies when it is seems to me to be more nuanced.

Last time I was in Seattle, downtown was full of the apparently homeless.

This doesn’t look right. Oregon marginal tax rates for a couple are 5% up $6300, 7% up to $15,900, and 9% up to $250,000 (which is also not my definition of very progressive). So how can a household in the top income quintile be paying around a 4% overall income tax rate? Even with massive deductions, it’s hard to see how one could get this much below 6%.

Yes, that is weird. How does Oregon treat capital gains? I should probably know this offhand, but I launder all mine through the DAF.

I believe the group that issues these reports subtracts the federal tax break that is given for paying Oregon income tax.

So, if one pays 9% Oregon income tax, and is in approximately a 40% federal tax bracket, they figure it as a 5% Oregon income tax liability — pretty close actually to the graph for the top group in Oregon.

One could certainly argue with this method of computing state and local tax burden.