Last updated on 05/31/2020

UO will be in the red on this deal until at least 2025.

It’s all preliminary, as follow up to this RFP, but it’s on the Board of Trustee’s agenda for June 4.

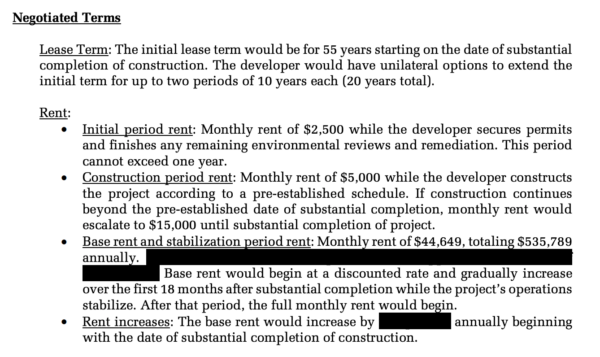

The payments are back-loaded – the earnest money deposit is only $150K net – so it’s not going to help with the budget crisis du jour:

FWIW, $535K is a bit more than the ~$470K UO’s academic side has to pay the Duck Athletic Department every year, as our contribution for the land that the Matt Knight arena is built on, thanks to this once secret MOU between Dave Frohnmayer and Pat Kilkenny.

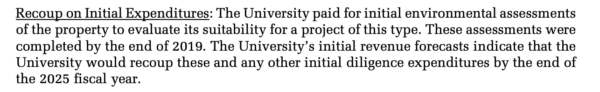

But meanwhile we’re already in the hole for this too:

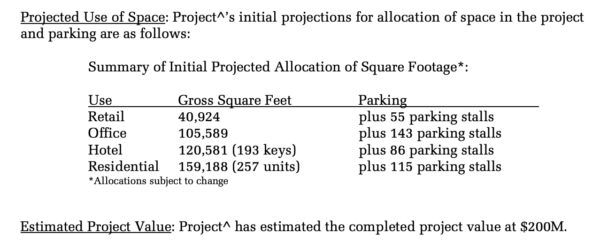

No worries, I’m sure the faculty and staff will be happy to take pay-cuts to cover these expenditures. And unlike Knight arena, maybe this thing will pay off someday:

If it does, Brian Obie is not going to be happy with this competition to his $75M 5th Street Market expansion:

I wonder what sort of tax incentives the city is going to give out.

maybe they can also sell duck cars …

Are they kidding? It’s not even clear that UO — or most universities — are going to survive in their present form — due most immediately to the corona virus. If they really want to do this, they should wait. There’s already plenty of new dorm space whose fate is uncertain. There could be a huge glut of apartment buildings in the area in a year or two. What’s the rush potentially to add more?

Plus, they’re talking about laying off potentially dozens, if not hundreds of NTTF, and who knows, TTF if they have to declare financial exigency. Talking about big salary cuts next year. This is not just idle talk; look at the tables.

We could well be in a new Great Depression that could last years.

I know Rockefeller Center was built during the last one. Do we have Rockefeller backing UO? Well, maybe, is there something I don’t know yet?

Really, this seems foolhardy right now, and in seriously bad taste.

We have no Rockefeller (who leased the land for Rock Center from Columbia) but we do have love and vague suggestions of support from Phil Knight, fwiw. We spent $30M for the Knight Arena land about 15 years ago. Back of the envelope the present value of this lease is about $37M. It seems much more sensible to sell the land outright – even in a depressed market. But then I’m no real estate lawyer.

The net present value of a $535,000 annual ground lease payment increased annually at 2.5% at a 4% cap rate would be about $20 million, or about $115/sf for the land.