From the FRB website press release, here:

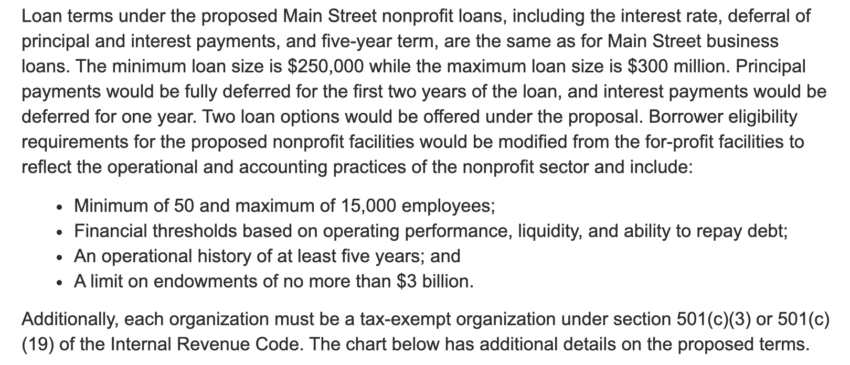

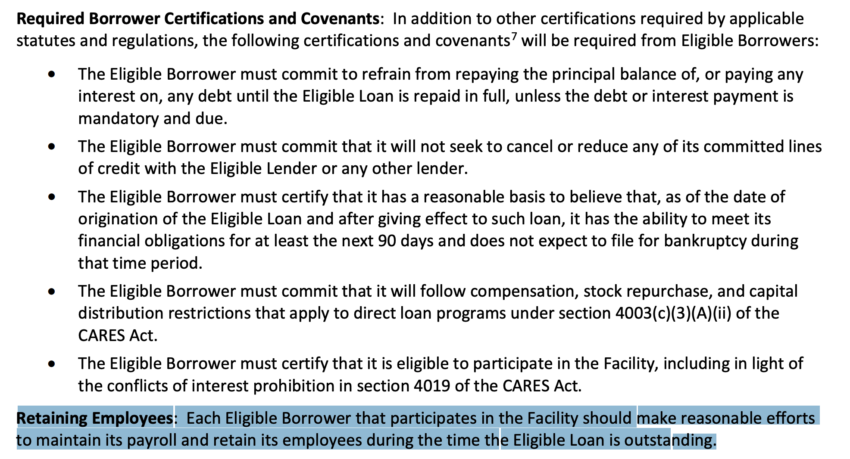

At this point the loan rules, which would apply to many public universities, are out for public comment. Eligible universities could borrow up to one quarter of expenses, or about $300M for UO. The proposed rules would discourage Johnson Hall from cutting payroll during the term of the loan:

I don’t see anything in them which would prevent Johnson Hall from using the money to, say, rescind the pay cuts President Schill, Rob Mullens, Mario Cristobal, and Dana Altman have accepted. In fact, the clause above might even be construed, by a creative and properly incentivized General Counsel, to require this.

And I have a heroin fix for you!

When did Schill and his underlings know about the act of vandalism that he “condemns”? Was it really beyond the capabilities of the very expensive UOPD to patrol 13th St. Saturday in the early evening?

Well, since UOPD spends their time in their SUV’s driving around hither and yon, is there any surprise that shit happens *on* campus that they don’t know or do anything about? Sure makes a person feel super-duper safe walking around campus, particularly at night, with UOPD driving outside of the campus itself. You could run to the UOPD office, but that’s a fair distance from… UO campus. Brilliant. Defund them.

But is it a problem for Schill et al. to keep their pay if everyone else gets their pay as well?

Apparently, eligibility is premised on the operating performance, liquidity, and capacity to repay loan. Moody’s recently stated the flagship isn’t good in any of those categories.

Also, none of that money can be used to be pay off existing loans. Given that it’s current debt loads that are the cause for concern for rating agencies, well, dayum, y’all ain’t gonna get the money…,,

How does moody’s rate uo compared to osu and psu?

Well, a quick look at Moody’s tells us:

OSU – Aa3 (21 March 2019) Outlook stable.

PSU – A1 (2 Oct 2018)

UO – Aa2 (20 Dec 2017). On 10 March this year Moody’s published Credit update following outlook revision to negative, but that’s locked and I’m not a subscriber.

What do those mean. ?

Aren’t you an academic

it took all of 5 seconds to find this out

Global Long-Term Rating Scale

Aaa Obligations rated Aaa are judged to be of the highest quality, subject to the lowest level of credit risk.

Aa Obligations rated Aa are judged to be of high quality and are subject to very low credit risk.

A Obligations rated A are judged to be upper-medium grade and are subject to low credit risk.

Baa Obligations rated Baa are judged to be medium-grade and subject to moderate credit risk and as such may possess certain speculative characteristics.

Ba Obligations rated Ba are judged to be speculative and are subject to substantial credit risk.

B Obligations rated B are considered speculative and are subject to high credit risk.

Caa Obligations rated Caa are judged to be speculative of poor standing and are subject to very high credit risk.

Ca Obligations rated Ca are highly speculative and are likely in, or very near, default, with some prospect of recovery of principal and interest.

C Obligations rated C are the lowest rated and are typically in default, with little prospect for recovery of principal or interest.

Yes, I’m an academic, I’ve yried to cultivate some skill at explaining things.